五、英文附加题(本题型共1题,共10分。答案中的金额单位以元表示,有小数的,保留两位小数,两位小数后四舍五入。用英文在答题卷上解答,答在试题卷上无效)。

Company A is a listed company located in P. R. China. On January 1, 20 X 4, Company A signed two share-based payment arrangements as follow:

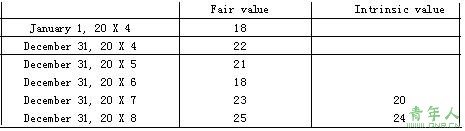

(a)The company granted 100 cash share appreciation rights (SARs) to each of its 300 senior management employees, conditional upon the employees remaining in the company‘s employ for the next three years. The cash share appreciation rights provided the employees with the right to receive, at the date the rights were exercised, cash equal to the appreciation in the company’s share price since the grant date. On December 31, 20 X 6, all SARs held by the remaining employees vested. They could be exercised during 20 X 7 and 20 X 8. The fair value and the intrinsic value (which equals the cash paid out) of SARs are shown below.

Management estimated, on the grant date, that 20% of the employees would leave evenly during the three-year period. During 20 X 4, 22 employees left the company and management predicted the same level of departure for the next two years. During 20 X 5, 20 employees left and management estimated that a further 15 employees would leave during year 3. Only 10 employees left during 20 X 6. At the end of 20 X 7, 110 employees exercised their SARs, another 138 employees exercised their SARs on December 12, 20 X 8.

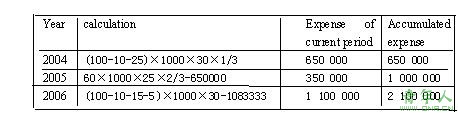

(b)The company made an award of 1000 share options to each of its 100 employees working in the sales department. The share option would vest at the end of 20 X 6, provided that the employees remained in the employ of the company till the date of vest, and provided that the company‘s earnings per share (EPS) increased by at least an average of 10% over the three-year period. The exercise price of each option was ¥15, but it would drop ;to ¥10 if EPS increased by an average of 15% or more.

On the grant date, the company estimated that the fair value of the share option was ¥25 per option if the exercise price was ¥15; ¥30 if the exercise price was ¥10.

In the year ended December 31, 20 X 4, the company‘s EPS increased by 16% and the management forecasted similar growth for the next two years. However, during 20 X 5, EPS increased by just 12% resulting in an average for the two-year period of 14%. Therefore, the management expected that EPS would continue to increase at 14% for 20 X 6. In the year 20 X 6, EPS of the company increased by 17% resulting in an average for the three-year period of 15%.

During 20 X 4, 10 employees left the company and the management predicted that a total of 35 employees would leave by the end of 20 X 6. 15 employees departed during 20 X 5, and hence 60 employees were expected to remain. By the end of 20 X 6, a further 5 employees had left.

Required:

Prepare accounting entries for the above transactions or events.

Answer:

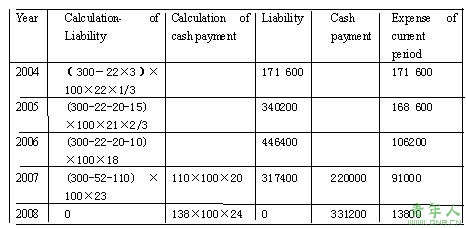

a)Calculations:

Journal entries:

(a) December 31, 20 X 4

Dr: Management expense 171 600 〔(300-22×3)×100×22×1/3〕

Cr: Wages & Salaries payable 171 600

December 31, 20 X 5

Dr: Management expense 168 600 〔(300-22-20-15)×100×21×2/3-171 600〕

Cr: Wages & Salaries payable 168 600

December 31, 20 X 6

Dr: Management expense 106 200 〔(300-22-20-10)×100×18-171600-168 600〕

Cr: Wages & Salaries payable 106 200

December 31, 20 X 7

Dr:Loss on the fair value change 91 000

Cr: Wages & Salaries payable 91 000

〔(300-22-20-10-110)×100×23-446 400+220 000〕

Dr:Wages & Salaries payable 220 000 (110×100×20)

Cr: Bank deposit 220 000

December 31, 20 X 8

Dr:Loss on the fair value change 13 800

Cr: Wages & Salaries payable 13 800〔0-317 400+331 200〕

Dr:Wages & Salaries payable 331 200 (138×100×24)

Cr: Bank deposit 331 200

b) (b) Calculations:

上一页 [1] [2] [3] [4] [5] [6] [7] [8]

责任编辑:小草